Digifinex FAQ - DigiFinex Exchange

Account

Why Can’t I Receive Emails from DigiFinex

If you are not receiving emails sent from DigiFinex, please follow the instructions below to check your email’s settings:

- Are you logged in to the email address registered to your DigiFinex account? Sometimes you might be logged out of your email on your devices and hence can’t see DigiFinex’s emails. Please log in and refresh.

- Have you checked the spam folder of your email? If you find that your email service provider is pushing DigiFinex emails into your spam folder, you can mark them as “safe” by whitelisting DigiFinex’s email addresses. You can refer to How to Whitelist DigiFinex Emails to set it up.

- Is your email client or service provider working normally? You can check the email server settings to confirm that there isn’t any security conflict caused by your firewall or antivirus software.

- Is your email inbox full? If you have reached the limit, you wont be able to send or receive emails. You can delete some of the old emails to free up some space for more emails.

- If possible, register from common email domains, such as Gmail, Outlook, etc.

Why Can’t I Receive SMS Verification Codes

DigiFinex continuously improves our SMS Authentication coverage to enhance user experience. However, there are some countries and areas currently not supported.

If you cannot enable SMS Authentication, please refer to our Global SMS coverage list to check if your area is covered. If your area is not covered on the list, please use Google Authentication as your primary two-factor authentication instead.

If you have enabled SMS Authentication or you are currently residing in a country or area that’s in our Global SMS coverage list, but you still cannot receiving SMS codes, please take the following steps:

- Ensure that your mobile phone has a good network signal.

- Disable your anti-virus and/or firewall and/or call blocker apps on your mobile phone that might potentially block our SMS Codes number.

- Restart your mobile phone.

- Try voice verification instead.

- Reset SMS Authentication.

How To Enhance DigiFinex Account Security

1. Password Settings

Please set a complex and unique password. For security purposes, make sure to use a password with at least 10 characters, including at least one uppercase and lowercase letter, one number, and one special symbol. Avoid using obvious patterns or information that is easily accessible to others (e.g. your name, email address, birthday, mobile number, etc.). Password formats we do not recommend: lihua, 123456, 123456abc, test123, abc123 Recommended password formats: Q@ng3532!, iehig4g@#1, QQWwfe@242!

2. Changing Passwords

We recommend that you change your password regularly to enhance the security of your account. It is best to change your password every three months and use a completely different password each time. For more secure and convenient password management, we recommend you to use a password manager such as "1Password" or "LastPass". In addition, please keep your passwords strictly confidential and do not disclose them to others. DigiFinex staff will never ask for your password under any circumstances.

3. Two-Factor Authentication (2FA) Linking Google Authenticator

Google Authenticator is a dynamic password tool launched by Google. You are required to use your mobile phone to scan the barcode provided by DigiFinex or enter the key. Once added, a valid 6-digit authentication code will be generated on the authenticator every 30 seconds. Upon successful linking, you need to enter or paste the 6-digit authentication code displayed on Google Authenticator every time you log in to DigiFinex.

4. Beware of Phishing

Please be vigilant of phishing emails pretending to be from DigiFinex, and always ensure that the link is the official DigiFinex website link before logging into your DigiFinex account. DigiFinex staff will never ask you for your password, SMS or email verification codes, or Google Authenticator codes.

What is Two-Factor Authentication?

Two-Factor Authentication (2FA) is an additional security layer to email verification and your account password. With 2FA enabled, you will have to provide the 2FA code when performing certain actions on the DigiFinex platform.How does TOTP work?

DigiFinex uses a Time-based One-time Password (TOTP) for Two-Factor Authentication, it involves generating a temporary, unique one-time 6-digit code* that is only valid for 30 seconds. You will need to enter this code to perform actions that affect your assets or personal information on the platform.

*Please keep in mind that the code should consist of numbers only.

How To Set Up Google Authenticator

1. Log in to the DigiFinex website, click on the [Profile] icon, and select [2 Factor Authentication].

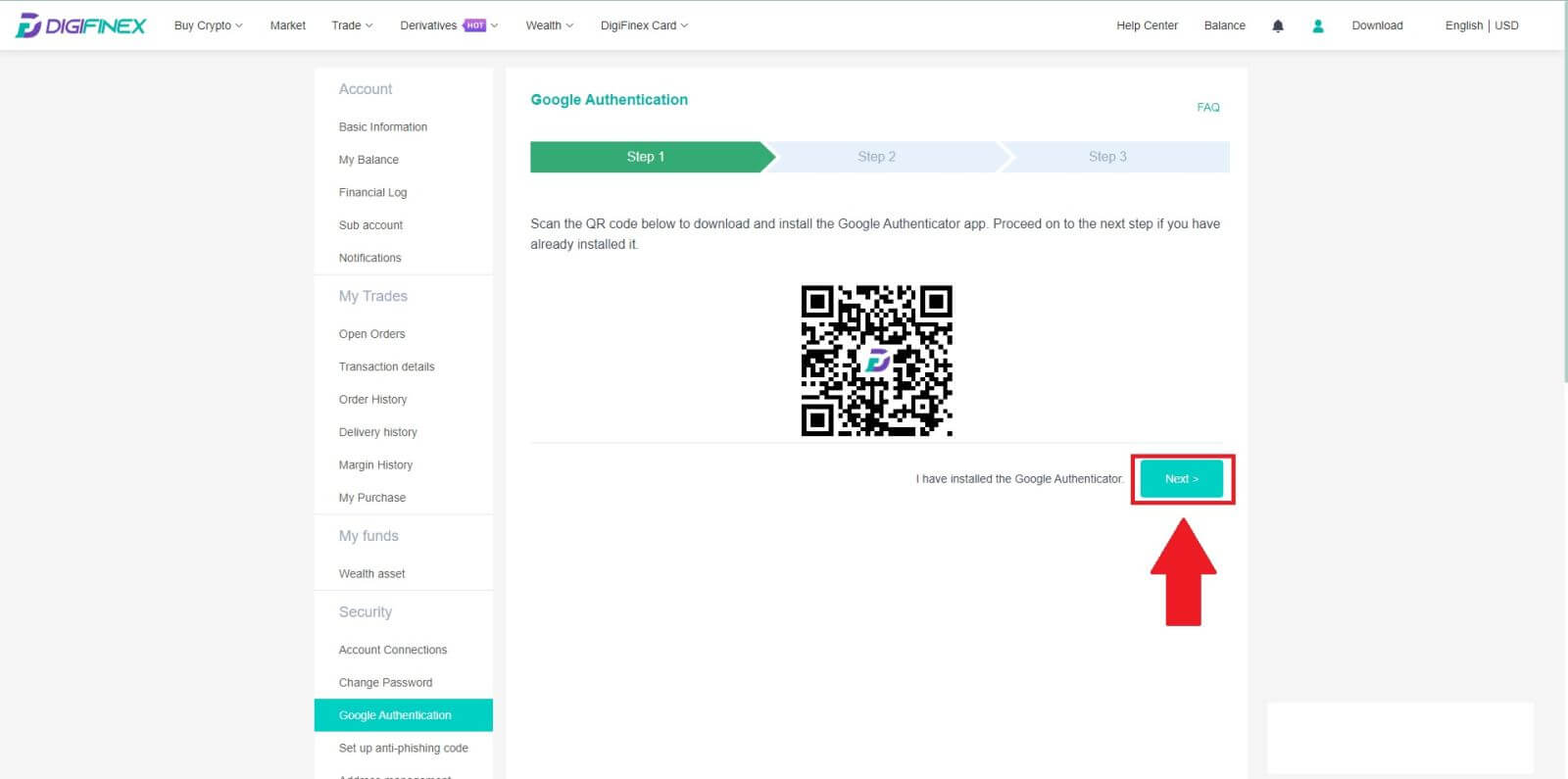

2. Scan the QR code below to download and install the Google Authenticator app. Proceed on to the next step if you have already installed it.Press [Next].

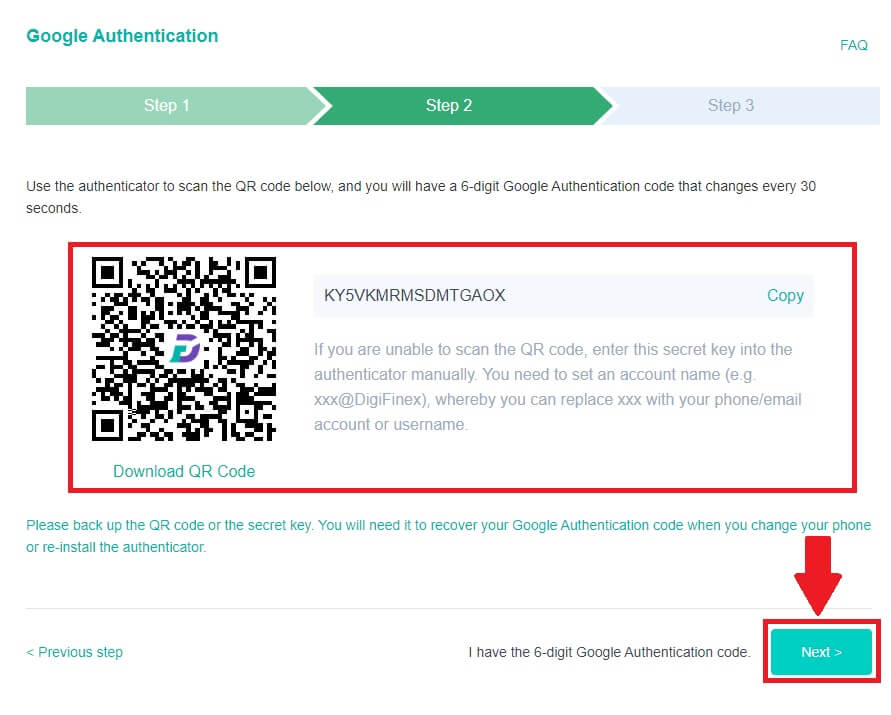

3. Scan the QR code with the authenticator to generate a 6-digit Google Authentication code, which updates every 30 seconds and press [Next ].

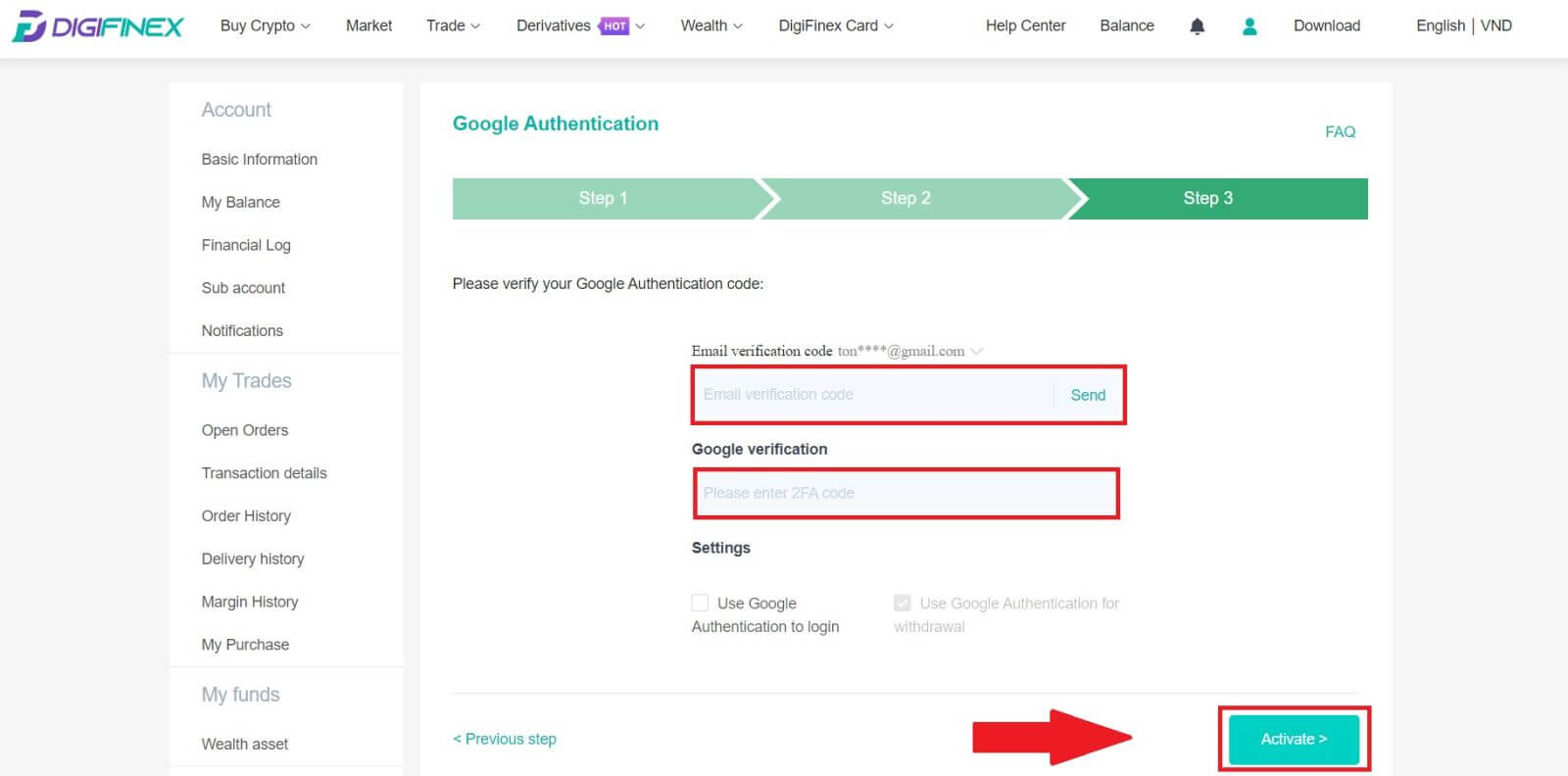

4. Click on [Send] and enter the 6-digit code that was sent to your email and the Authenticator code. Click [Activate] to complete the process.

Verification

What kind of documents do you accept? Are there any requirements on the file size?

Accepted document formats include JPEG and PDF, with a minimum file size requirement of 500KB. Screenshots are not eligible. Kindly submit either a PDF-formatted digital copy of the original document or a photograph of the physical document.

Identity Verification for Buying Crypto with Credit/Debit Card

In order to ensure a stable and compliant fiat gateway, users buying crypto with credit debit cards are required to complete Identity Verification. Users who have already completed Identity Verification for the DigiFinex account will be able to continue to buy crypto without any additional information required. Users who are required to provide extra information will be prompted the next time they attempt to make a crypto purchase with a credit or debit card.

Each Identity Verification level completed will grant increased transaction limits. All transaction limits are fixed to the value of the USDT regardless of the fiat currency used and thus will vary slightly in other fiat currencies according to exchange rates.

How to pass the different KYC levels?

Lv1. Proof of Identity

Choose the country and specify the ID type (National ID Card or Passport) you intend to use. Ensure that all document corners are visible, with no extra objects or graphics. For National ID Cards, upload both sides, and for Passports, include both the photo/information page and the signature page, ensuring the signature is visible.

Lv2. Liveness Check

Position yourself in front of the camera and gradually turn your head in a complete circle for our liveness verification process.

Lv3. Proof of Address

Provide documents as evidence of your address for the purpose of verification. Ensure that the document includes both your complete name and address, and that it has been issued within the last three months. Accepted types of PoA include:

- Bank statement/ Credit Card statement(issued by a bank) with the date of issue and the name of the person (the document must be not older than 3 months);

- Utility bill for gas, electricity, water, linked to the property (the document must not be older than 3 months);

- Correspondence with a government authority (the document must not be older than 3 months);

- National ID document with the name and address (MUST be different from the ID document submitted as proof of identity).

Deposit

How long does it take for my funds to arrive? What is the transaction fee?

After confirming your request on DigiFinex, it takes time for the transaction to be confirmed on the blockchain. The confirmation time varies depending on the blockchain and its current network traffic.

For example, if you’re depositing USDT, DigiFinex supports the ERC20, BEP2, and TRC20 networks. You can select the desired network from the platform you’re withdrawing from, enter the amount to withdraw, and you will see the relevant transaction fees.

The funds will be credited to your DigiFinex account shortly after the network confirms the transaction.

Please note if you entered the wrong deposit address or selected an unsupported network, your funds will be lost. Always check carefully before you confirm the transaction.

How to check my transaction history?

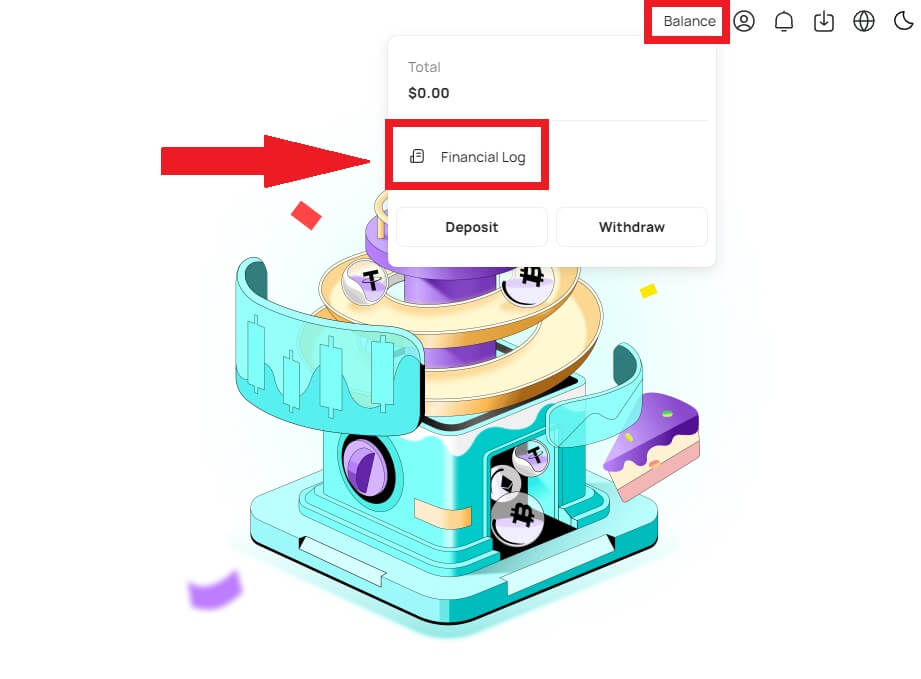

You can check the status of your deposit or withdrawal from [Balance] - [Financial Log] - [Transaction History].

Why Hasn’t My Deposit Been Credited

Transferring funds from an external platform to DigiFinex involves three steps:

- Withdrawal from the external platform

- Blockchain network confirmation

- DigiFinex credits the funds to your account

An asset withdrawal marked as “completed” or “success” in the platform youre withdrawing your crypto from means that the transaction was successfully broadcast to the blockchain network. However, it might still take some time for that particular transaction to be fully confirmed and credited to the platform you’re withdrawing your crypto to. The amount of required “network confirmations” varies for different blockchains.

For example:

- Mike wants to deposit 2 BTC into his DigiFinex wallet. The first step is to create a transaction that will transfer the funds from his personal wallet into DigiFinex.

- After creating the transaction, Mike needs to wait for the network confirmations. He will be able to see the pending deposit on his DigiFinex account.

- The funds will be temporarily unavailable until the deposit is complete (1 network confirmation).

- If Mike decides to withdraw these funds, he needs to wait for 2 network confirmations.

- If the transaction has not yet been fully confirmed by the blockchain network nodes, or has not reached the minimum amount of network confirmations specified by our system, please wait patiently for it to be processed. When the transaction has been confirmed, DigiFinex will credit the funds to your account.

- If the transaction is confirmed by the blockchain but not credited to your DigiFiex account, you may check the deposit status from the Deposit Status Query. You can then follow the instructions on the page to check your account, or submit an enquiry for the issue.

Withdraw

Why has my withdrawal not arrived?

I’ve made a withdrawal from DigiFinex to another exchange/wallet, but I haven’t received my funds yet. Why?

Transferring funds from your DigiFinex account to another exchange or wallet involves three steps:

- Withdrawal request on DigiFinex.

- Blockchain network confirmation.

- Deposit on the corresponding platform.

Normally, a TxID (Transaction ID) will be generated within 30-60 minutes, indicating that DigiFinex has successfully broadcasted the withdrawal transaction.

However, it might still take some time for that particular transaction to be confirmed and even longer for the funds to be finally credited into the destination wallet. The amount of required “network confirmations” varies for different blockchains.

What Can I Do When I Withdraw to A Wrong Address?

If you mistakenly withdraw funds to a wrong address, DigiFinex is unable to locate the receiver of your funds and provide you any further assistance. As our system initiates the withdrawal process as soon as you click [Submit] after completing security verification.

How can I retrieve the funds withdraw to a wrong address?

- If you sent your assets to an incorrect address by mistake and you know the owner of this address, please contact the owner directly.

- If your assets were sent to a wrong address on another platform, please contact the customer support of that platform for assistance.

Trade Crypto

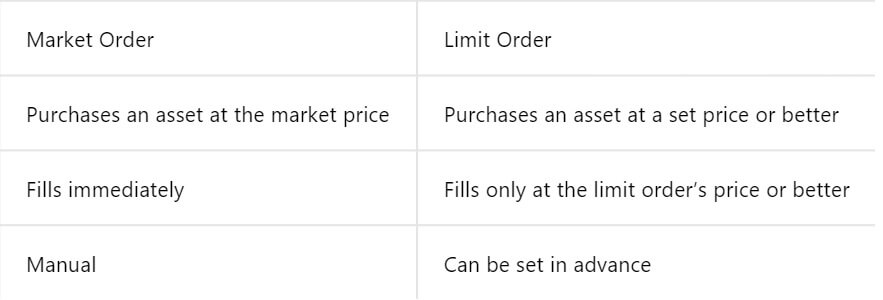

What is Limit Order

A limit order is an instruction to buy or sell an asset at a specified limit price, which is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches the designated limit price or surpasses it favorably. This allows traders to aim for specific buying or selling prices different from the prevailing market rate.

For instance:

- If you set a buy limit order for 1 BTC at $60,000 while the current market price is $50,000, your order will be promptly filled at the prevailing market rate of $50,000. This is because it represents a more favorable price than your specified limit of $60,000.

- Similarly, if you place a sell limit order for 1 BTC at $40,000 when the current market price is $50,000, your order will be immediately executed at $50,000, as it is a more advantageous price compared to your designated limit of $40,000.

In summary, limit orders provide a strategic way for traders to control the price at which they buy or sell an asset, ensuring execution at the specified limit or a better price in the market.

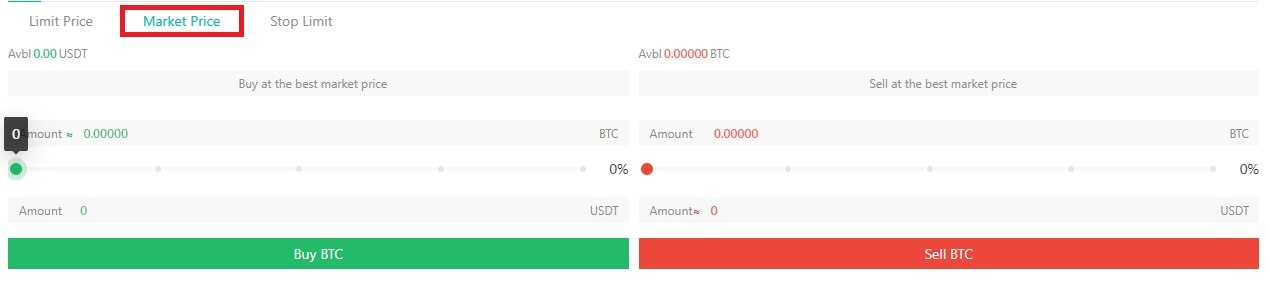

What is Market Order

A market order is a type of trading order that is executed promptly at the current market price. When you place a market order, it is fulfilled as swiftly as possible. This order type can be utilized for both buying and selling financial assets.

When placing a market order, you have the option to specify either the quantity of the asset you want to buy or sell, denoted as [Amount], or the total amount of funds you wish to spend or receive from the transaction.

For instance, if you intend to purchase a specific quantity, you can directly enter the amount. Conversely, if you aim to acquire a certain amount with a specified sum of funds, like 10,000 USDT. This flexibility allows traders to execute transactions based on either a predetermined quantity or a desired monetary value.

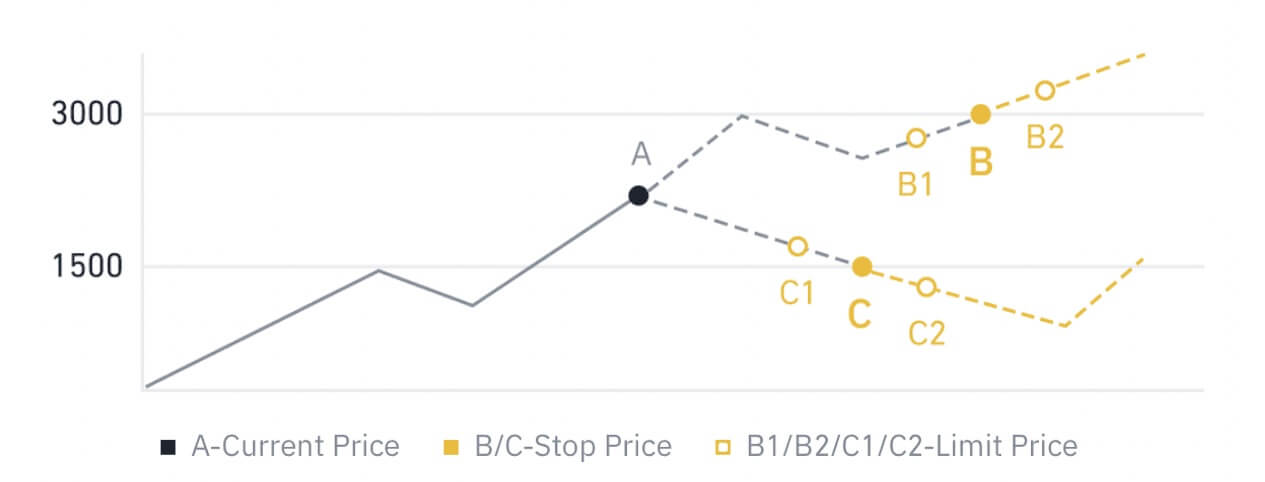

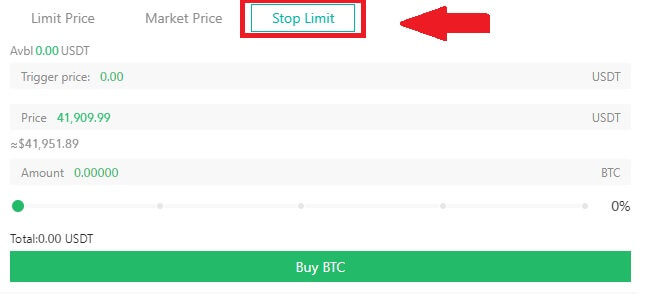

What is the Stop-Limit Function and How to use it

A stop-limit order is a specific type of limit order used in trading financial assets. It involves setting both a stop price and a limit price. Once the stop price is reached, the order is activated, and a limit order is placed on the market. Subsequently, when the market reaches the specified limit price, the order is executed.

Here’s how it works:

- Stop Price: This is the price at which the stop-limit order is triggered. When the asset’s price hits this stop price, the order becomes active, and the limit order is added to the order book.

- Limit Price: The limit price is the designated price or a potentially better one at which the stop-limit order is intended to be executed.

It’s advisable to set the stop price slightly higher than the limit price for sell orders. This price difference provides a safety margin between the activation of the order and its fulfillment. Conversely, for buy orders, setting the stop price slightly lower than the limit price helps minimize the risk of the order not being executed.

It’s important to note that once the market price reaches the limit price, the order is executed as a limit order. Setting the stop and limit prices appropriately is crucial; if the stop-loss limit is too high or the take-profit limit is too low, the order may not be filled because the market price may not reach the specified limit.

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Note

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

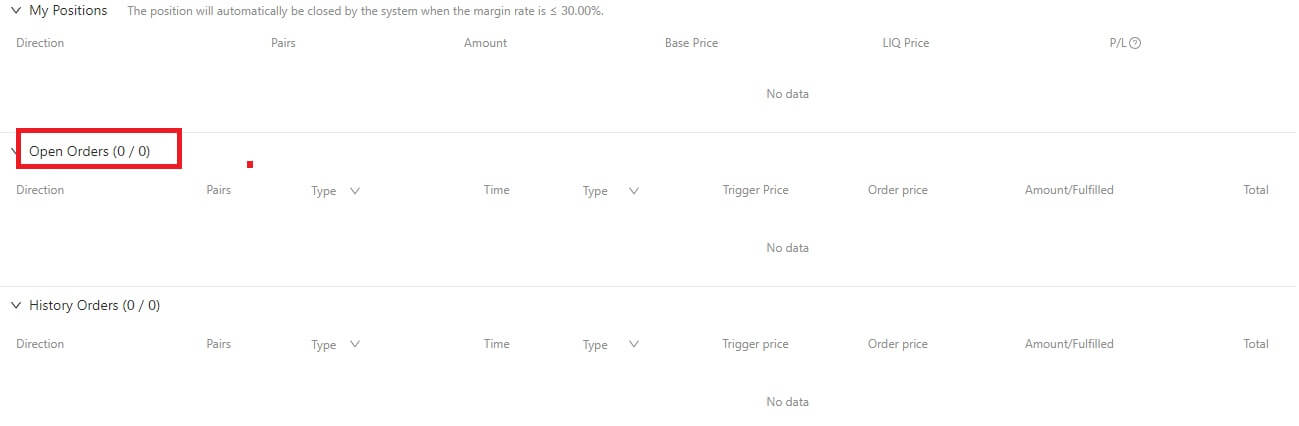

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:

- Trading pair.

- Order Date.

- Order Type.

- Side.

- Order price.

- Order Quantity.

- Order amount.

- Filled %.

- Trigger conditions.

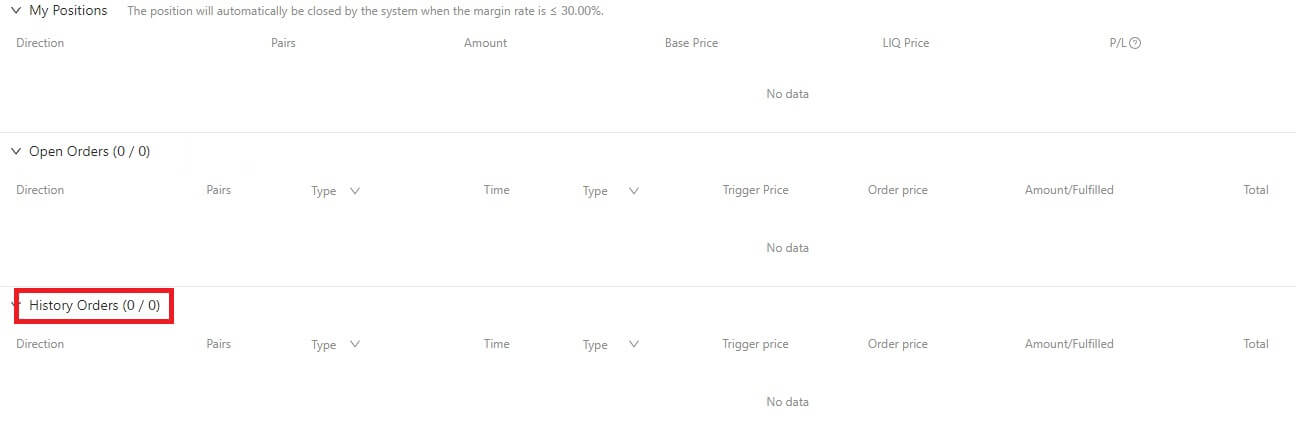

2. History Orders

History Orders displays a record of your filled and unfilled orders over a certain period. You can view order details, including:

- Trading Pair.

- Order Date.

- Order Type.

- Side.

- Average Filled Price.

- Order Price.

- Executed.

- Order Quantity.

- Order Amount.

- Total amount.

Types of Order on DigiFinex Futures

If the trigger price is set, when the benchmark price (market price, index price, fair price) selected by the user reaches the trigger price, it will be triggered, and a market order will be placed with the quantity set by the user.

Note: The user’s funds or positions will not be locked when setting the trigger. The trigger may fail due to high market volatility, price restrictions, position limits, insufficient collateral assets, insufficient closeable volume, futures in non-trading status, system issues, etc. A successful trigger limit order is the same as a normal limit order, and it may not be executed. Unexecuted limit orders will be displayed in active orders.

TP/SL

TP/SL refers to the pre-set trigger price (take profit price or stop loss price) and trigger price type. When the last price of the specified trigger price type reaches the pre-set trigger price, the system will place a close market order according to the pre-set quantity in order to take profit or stop loss. Currently, there are two ways to place a stop loss order:

- Set TP/SL when opening a position: This means to set TP/SL in advance for a position that is about to be opened. When the user places an order to open a position, they can click to set a TP/SL order at the same time. When the open position order is filled (partially or fully), the system will immediately place a TP/SL order with the trigger price and trigger price type pre-set by the user. (This can be viewed in open orders under TP/SL.)

- Set TP/SL when holding a position: Users can set a TP/SL order for a specified position when holding a position. After the setting is complete, when the last price of the specified trigger price type meets the trigger condition, the system will place a close market order according to the quantity set in advance.

Stop Limit Order

If the trigger price is set, when the benchmark price (market price, index price, fair price) selected by the user reaches the trigger price, it will be triggered, and a limit order will be placed at the order price and quantity set by the user.

Stop Market Order

If the trigger price is set, when the benchmark price (market price, index price, fair price) selected by the user reaches the trigger price, it will be triggered, and a market order will be placed with the quantity set by the user.

Note: The user’s funds or positions will not be locked when setting the trigger. The trigger may fail due to high market volatility, price restrictions, position limits, insufficient collateral assets, insufficient closeable volume, futures in non-trading status, system issues, etc. A successful trigger limit order is the same as a normal limit order, and it may not be executed. Unexecuted limit orders will be displayed in active orders.

Isolated and Cross Margin Mode

Isolated Margin Mode

A trading configuration that assigns a specific amount of margin to a particular position. This approach ensures that the margin allocated to that position is ring-fenced and does not draw upon the overall account balance.

Cross Margin Mode

Operates as a margin model that utilizes the entire available balance in the trading account to support a position. In this mode, the entirety of the account balance is considered collateral for the position, providing a more comprehensive and flexible approach to managing margin requirements.

|

Isolated Margin Mode |

Cross Margin Mode |

|

|

Challenges |

A restricted margin will be assigned to each position. |

Utilization of the entire available balance in the account as margin. |

|

With separate margins applied to each individual position, profits and losses in one position do not impact others. |

Sharing of margin across all positions, allowing for hedging of profits and losses between multiple swaps. |

|

|

If liquidation is triggered, only the margin associated with the relevant position will be affected. |

Complete loss of the entire account balance in the event of a liquidation trigger. |

|

|

Advantages |

Margin is isolated, which limits losses to a certain range. Suitable for more volatile and high leverage ratio situations. |

Hedging of profit and loss between multiple swaps, leading to reduced margin requirements. Increased utilization of capital for more efficient trading. |

Differences between Coin Margined Perpetual Futures and USDT Margined Perpetual Futures

1. Different crypto is used as the valuation unit, collateral asset, and calculation of PNL:

- In USDT margined perpetual futures, valuation and pricing are in USDT, with USDT also used as collateral, and PNL calculated in USDT. Users can engage in diverse futures trading by holding USDT.

- For Coin margined perpetual futures, pricing and valuation are in US dollars (USD), utilizing the underlying cryptocurrency as collateral, and calculating PNL with the underlying crypto. Users can participate in specific futures trading by holding the corresponding underlying crypto.

- The value of each contract in USDT margined perpetual futures is derived from the associated underlying cryptocurrency, exemplified by the 0.0001 BTC face value for BTCUSDT.

- In Coin margined perpetual futures, the price of each contract is fixed in US dollars, as seen in the 100 USD face value for BTCUSD.

- In USDT margined perpetual futures, the collateral asset required is USDT. When the price of the underlying crypto falls, it does not affect the value of the USDT collateral asset.

- In Coin marginedperpetual futures, the collateral asset required corresponds to the underlying crypto. When the price of the underlying crypto falls, the collateral assets required for the users’ positions increase, and more of the underlying crypto is needed as collateral.