How to Trade Crypto on DigiFinex

How to Trade Spot on DigiFinex (Web)

A spot trade is a simple transaction between a buyer and a seller to trade at the current market rate, known as the spot price. The trade takes place immediately when the order is fulfilled.

Users can prepare spot trades in advance to trigger when a specific (better) spot price is reached, known as a limit order. You can make spot trades on DigiFinex through our trading page interface.

1. Visit our DigiFinex website, and click on [Log in] at the top right of the page to log into your DigiFinex account.

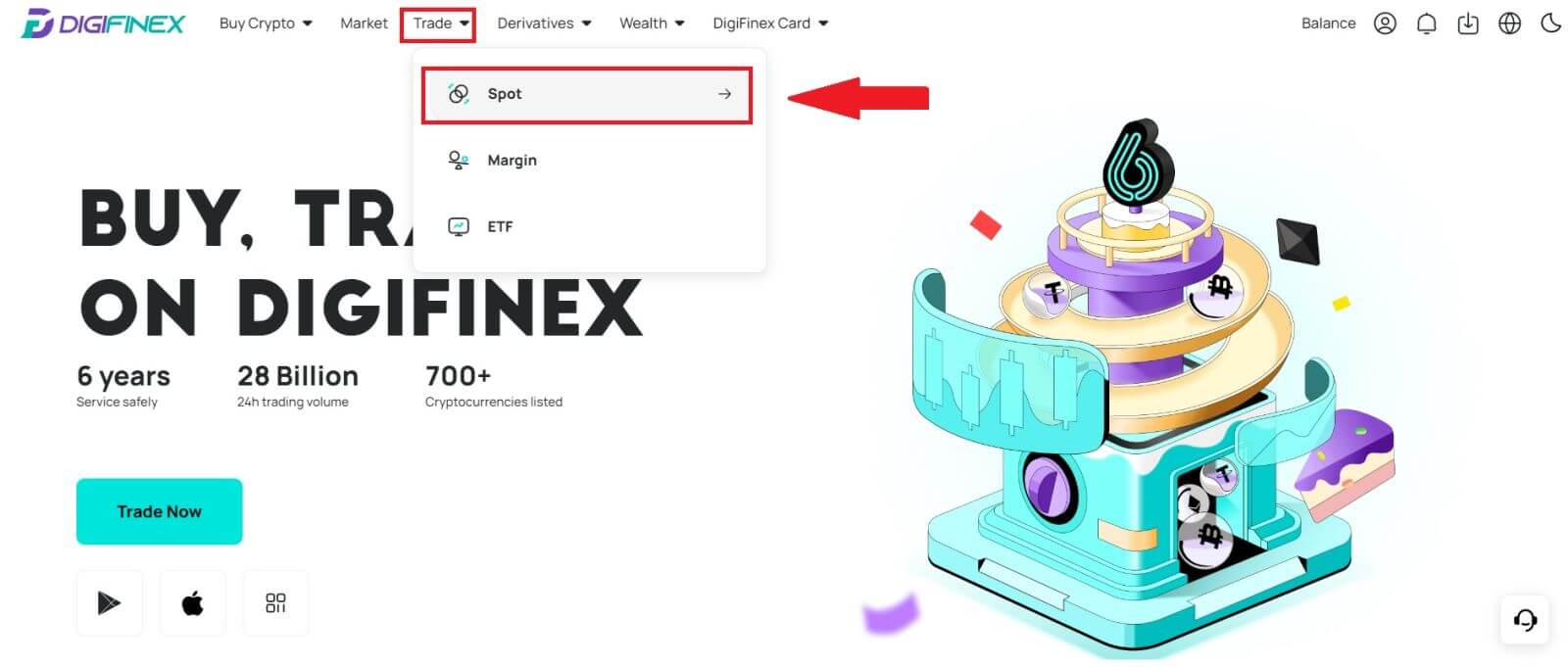

2. Tap on [Spot] in [Trade].

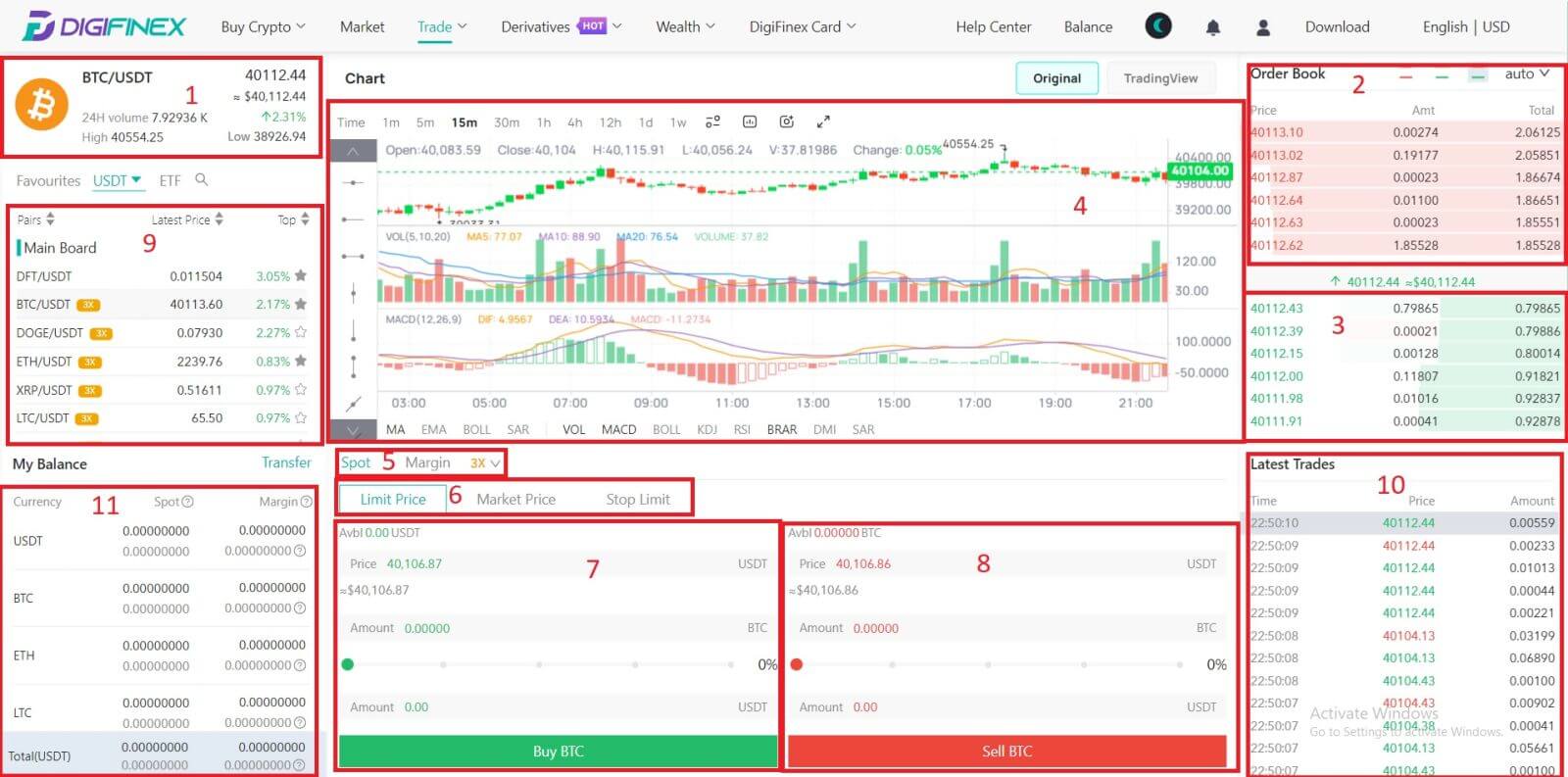

3. You will now find yourself on the trading page interface.

- Market Price Trading volume of trading pair in 24 hours.

- Asks (Sell orders) book.

- Bids (Buy orders) book.

- Candlestick chart and Technical Indicators.

- Trading Type: Spot / Margin / 3X.

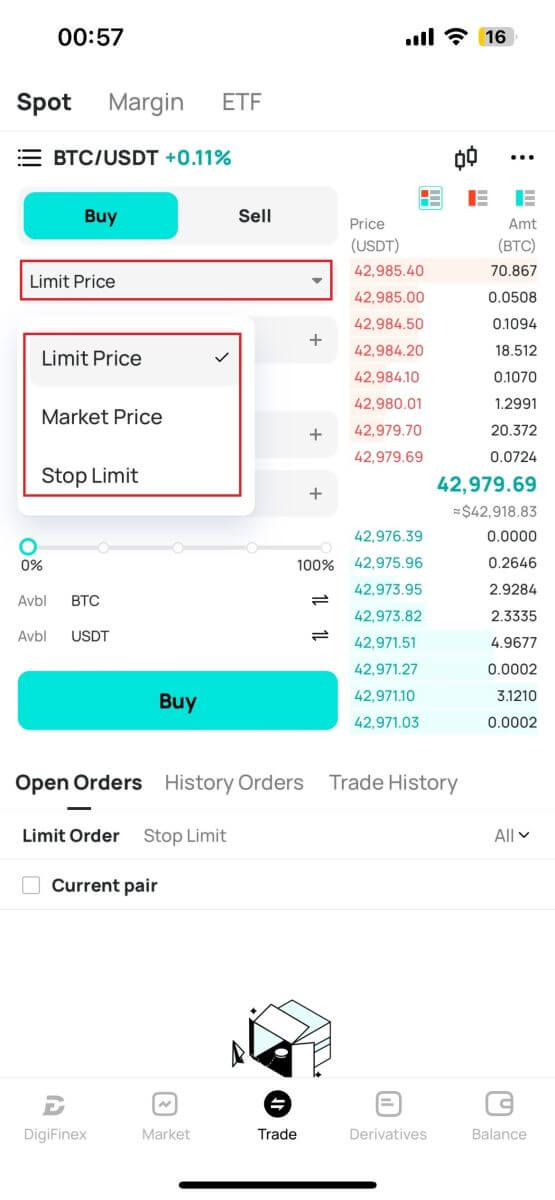

- Type of order: Limit / Market / Stop-limit.

- Buy Cryptocurrency.

- Sell Cryptocurrency.

- Market and Trading pairs.

- Market latest completed transaction.

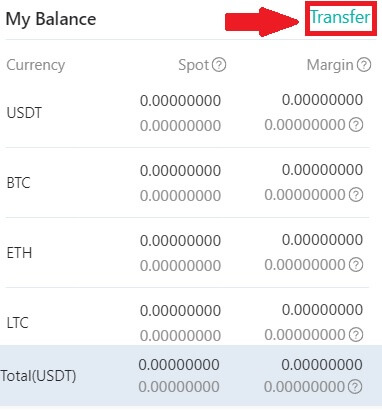

- My Balance

- Your Limit Order / Stop-limit Order / Order History

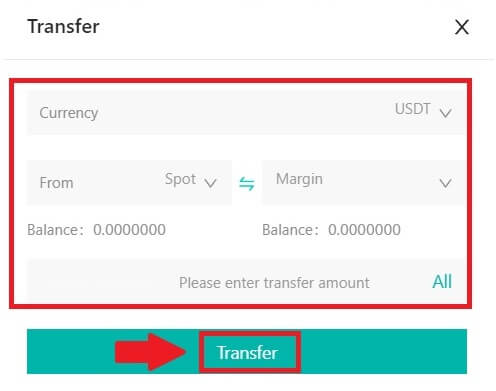

4. Transfer Funds to Spot Account

Click [Transfer] in My Balance.

Select your Currency and enter the amount, click [Transfer] .

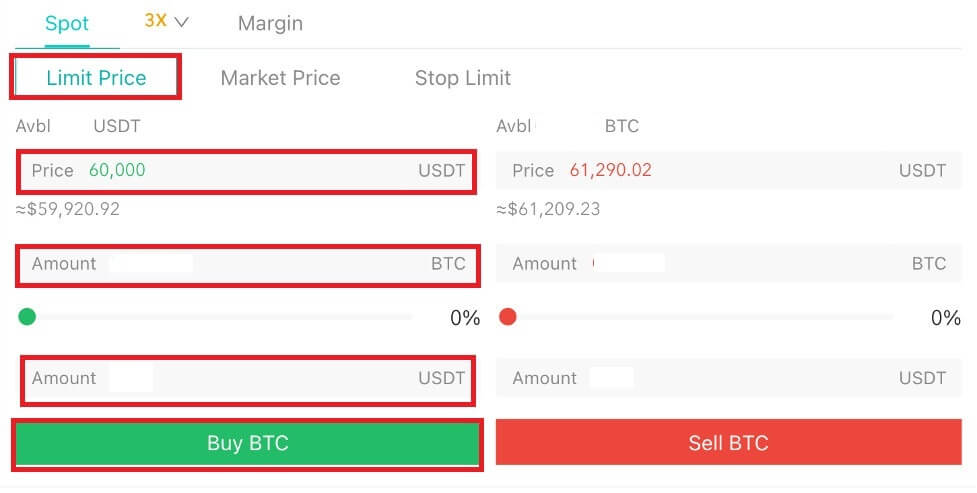

5. Buy Crypto.

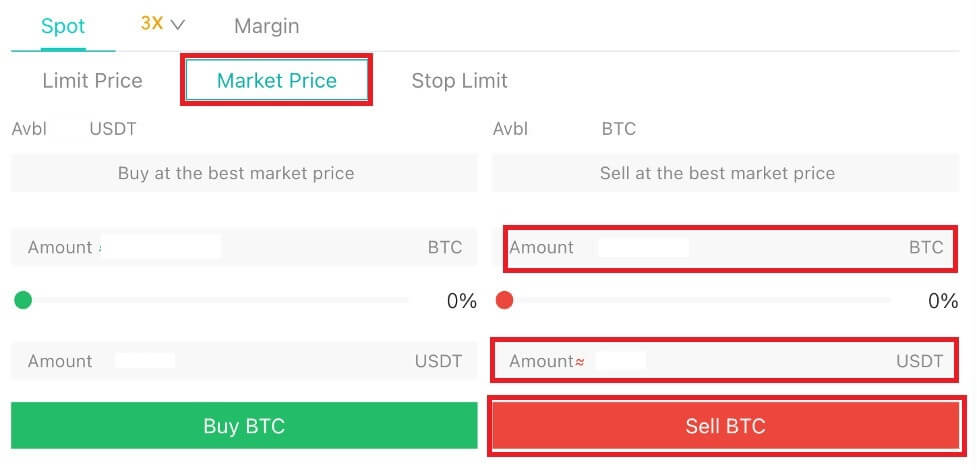

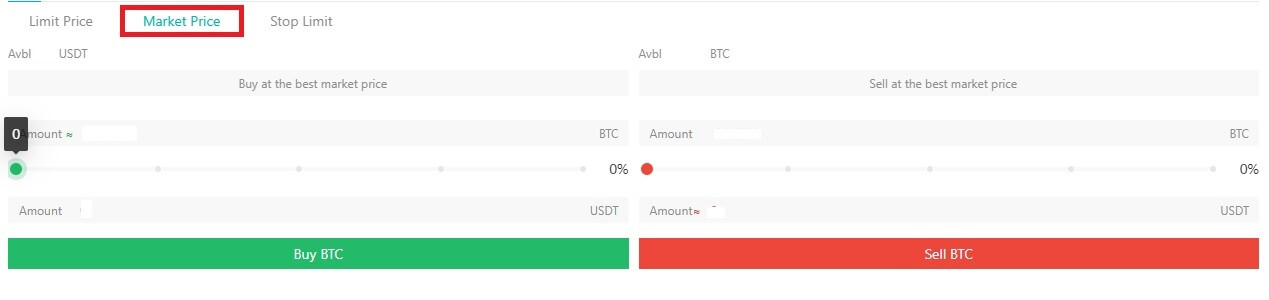

The default order type is a limit order, which allows you to specify a particular price for buying or selling crypto. However, if you wish to execute your trade promptly at the current market price, you can switch to a [Market Price] Order. This enables you to trade instantly at the prevailing market rate.

For instance, if the current market price of BTC/USDT is $61,000, but you desire to purchase 0.1 BTC at a specific price, say $60,000, you can place a [Limit Price] order.

Once the market price reaches your specified amount of $60,000, your order will be executed, and you will find 0.1 BTC (excluding commission) credited to your spot account.

6. Sell Crypto.

To promptly sell your BTC, consider switching to a [Market Price] order. Enter the selling quantity as 0.1 to complete the transaction instantly.

For example, if the current market price of BTC is $63,000 USDT, executing a [Market Price] Order will result in 6,300 USDT (excluding commission) being credited to your Spot account immediately.

How to Trade Spot on DigiFinex (App)

Here’s how to start trading Spot on DigiFinex App:

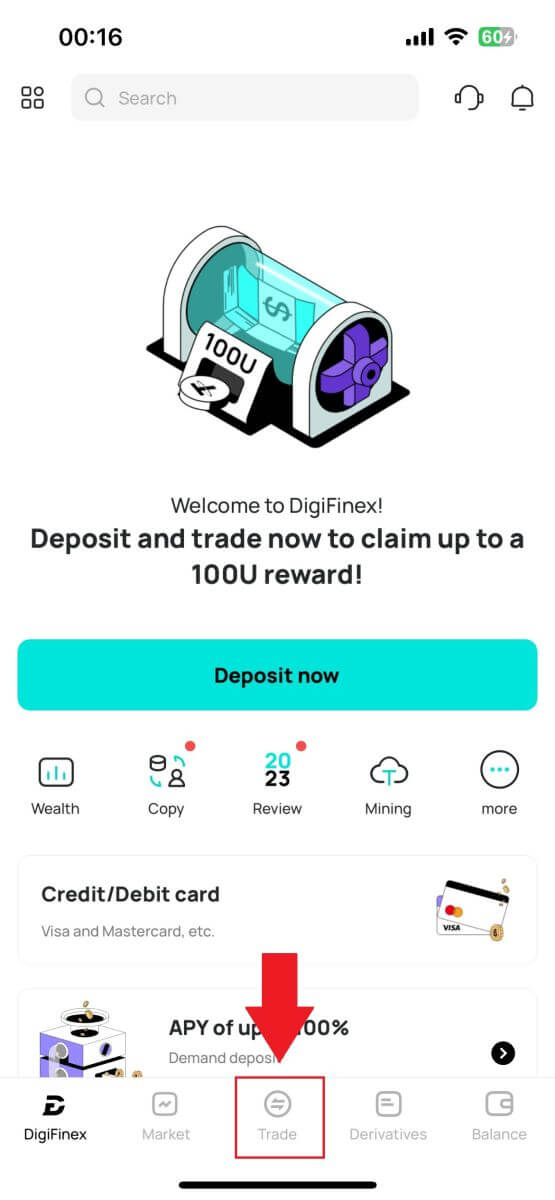

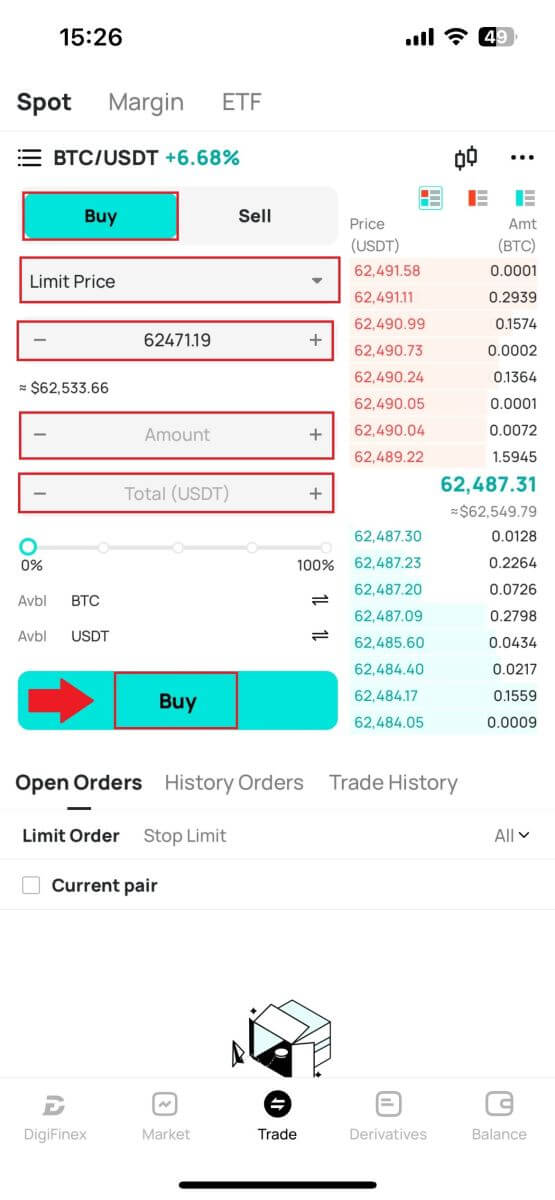

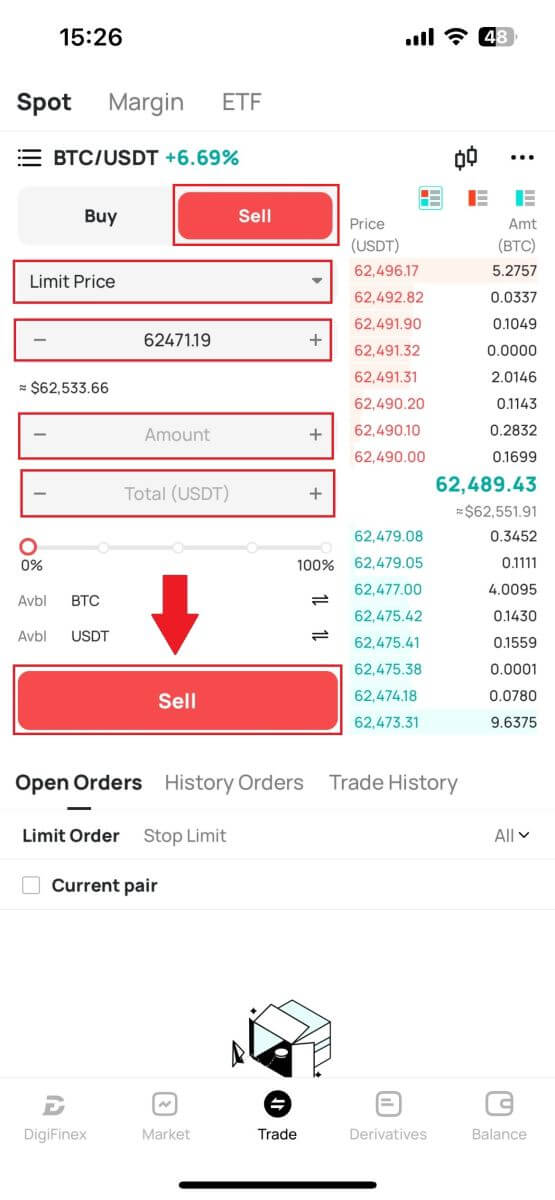

1. On your DigiFinex App, tap [Trade] on the bottom to head to the spot trading interface.

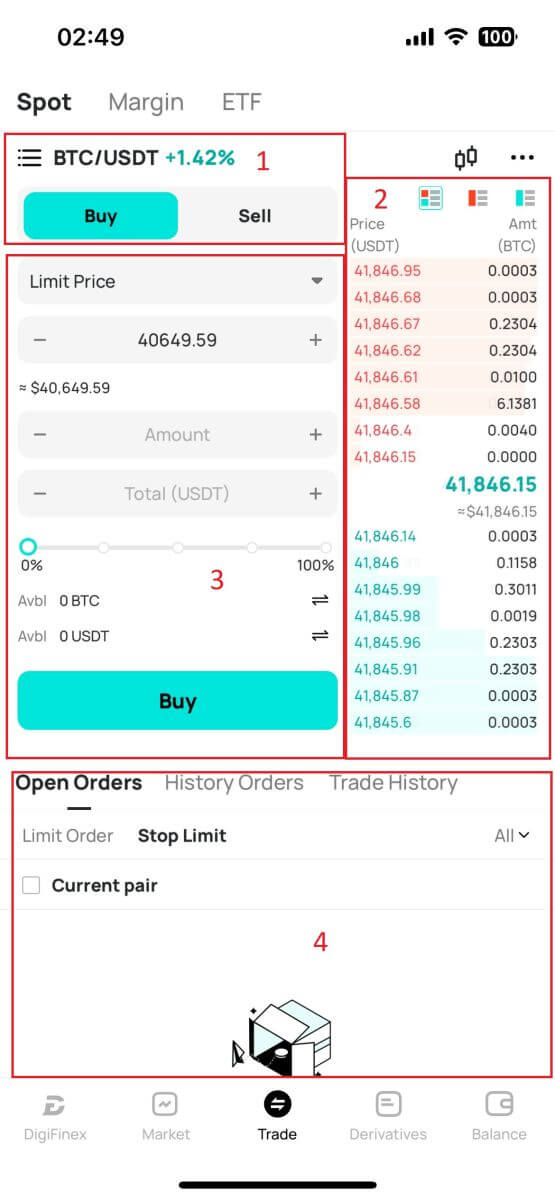

2. Here is the trading page interface.

- Market and Trading pairs.

- Sell/Buy order book.

- Buy/Sell Cryptocurrency.

- Open orders.

4. Enter Price and Amount.

Click "Buy/Sell" to confirm the order.

Tips: Limit Price order won’t success immediately. It only becomes to a pending order and will be succeeded when the Market price fluctuating to this value.

You can see the current status in the Open order option and cancel it before its success.

Frequently Asked Questions (FAQ)

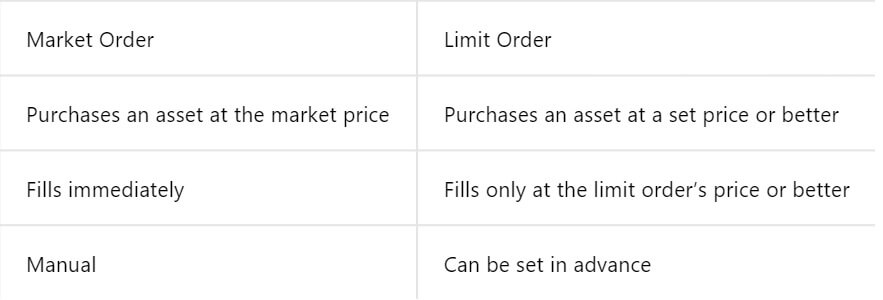

What is Limit Order

A limit order is an instruction to buy or sell an asset at a specified limit price, which is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches the designated limit price or surpasses it favorably. This allows traders to aim for specific buying or selling prices different from the prevailing market rate.

For instance:

- If you set a buy limit order for 1 BTC at $60,000 while the current market price is $50,000, your order will be promptly filled at the prevailing market rate of $50,000. This is because it represents a more favorable price than your specified limit of $60,000.

- Similarly, if you place a sell limit order for 1 BTC at $40,000 when the current market price is $50,000, your order will be immediately executed at $50,000, as it is a more advantageous price compared to your designated limit of $40,000.

In summary, limit orders provide a strategic way for traders to control the price at which they buy or sell an asset, ensuring execution at the specified limit or a better price in the market.

What is Market Order

A market order is a type of trading order that is executed promptly at the current market price. When you place a market order, it is fulfilled as swiftly as possible. This order type can be utilized for both buying and selling financial assets.

When placing a market order, you have the option to specify either the quantity of the asset you want to buy or sell, denoted as [Amount], or the total amount of funds you wish to spend or receive from the transaction.

For instance, if you intend to purchase a specific quantity, you can directly enter the amount. Conversely, if you aim to acquire a certain amount with a specified sum of funds, like 10,000 USDT. This flexibility allows traders to execute transactions based on either a predetermined quantity or a desired monetary value.

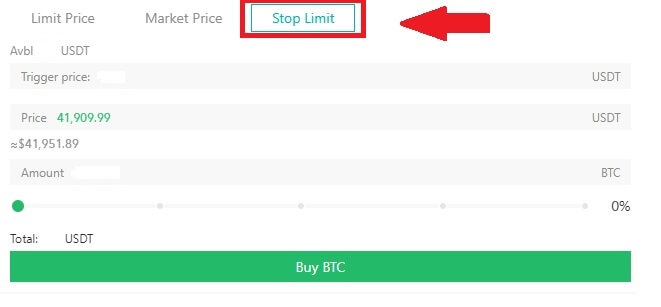

What is the Stop Limit Function and How to use it

A stop-limit order is a specific type of limit order used in trading financial assets. It involves setting both a stop price and a limit price. Once the stop price is reached, the order is activated, and a limit order is placed on the market. Subsequently, when the market reaches the specified limit price, the order is executed.

Here’s how it works:

- Stop Price: This is the price at which the stop-limit order is triggered. When the asset’s price hits this stop price, the order becomes active, and the limit order is added to the order book.

- Limit Price: The limit price is the designated price or a potentially better one at which the stop-limit order is intended to be executed.

It’s advisable to set the stop price slightly higher than the limit price for sell orders. This price difference provides a safety margin between the activation of the order and its fulfillment. Conversely, for buy orders, setting the stop price slightly lower than the limit price helps minimize the risk of the order not being executed.

It’s important to note that once the market price reaches the limit price, the order is executed as a limit order. Setting the stop and limit prices appropriately is crucial; if the stop-loss limit is too high or the take-profit limit is too low, the order may not be filled because the market price may not reach the specified limit.

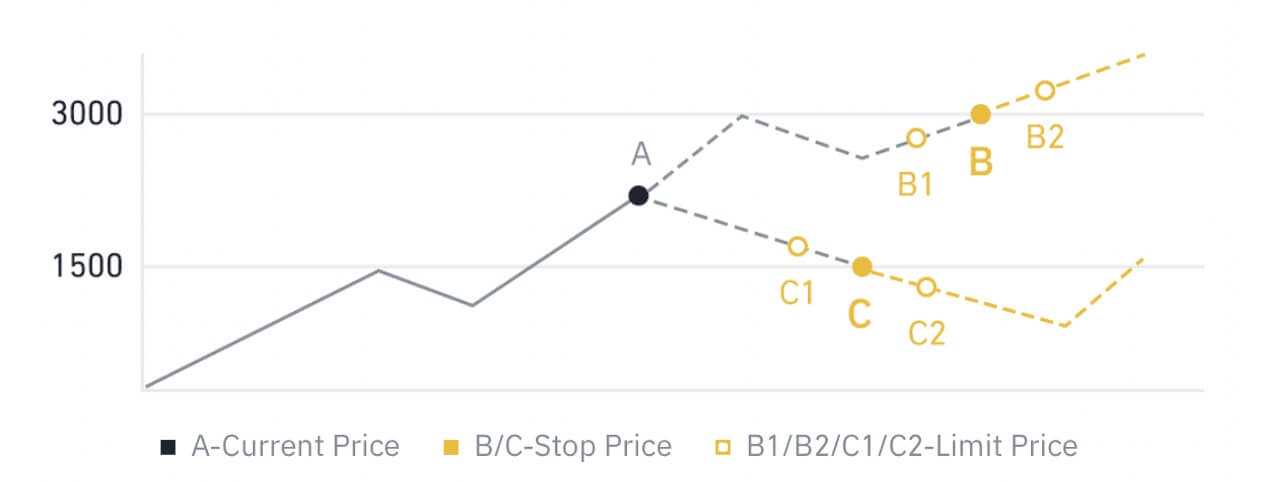

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

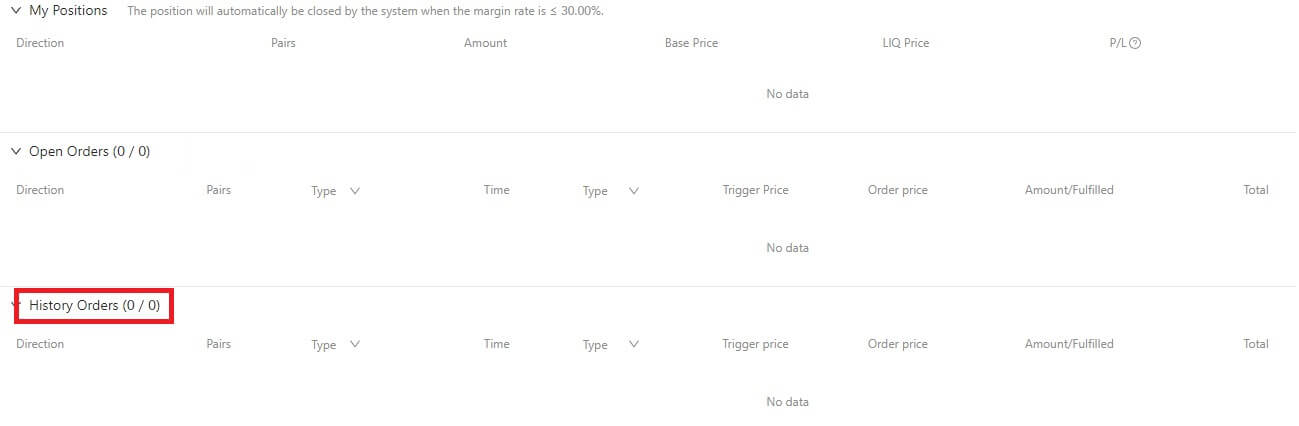

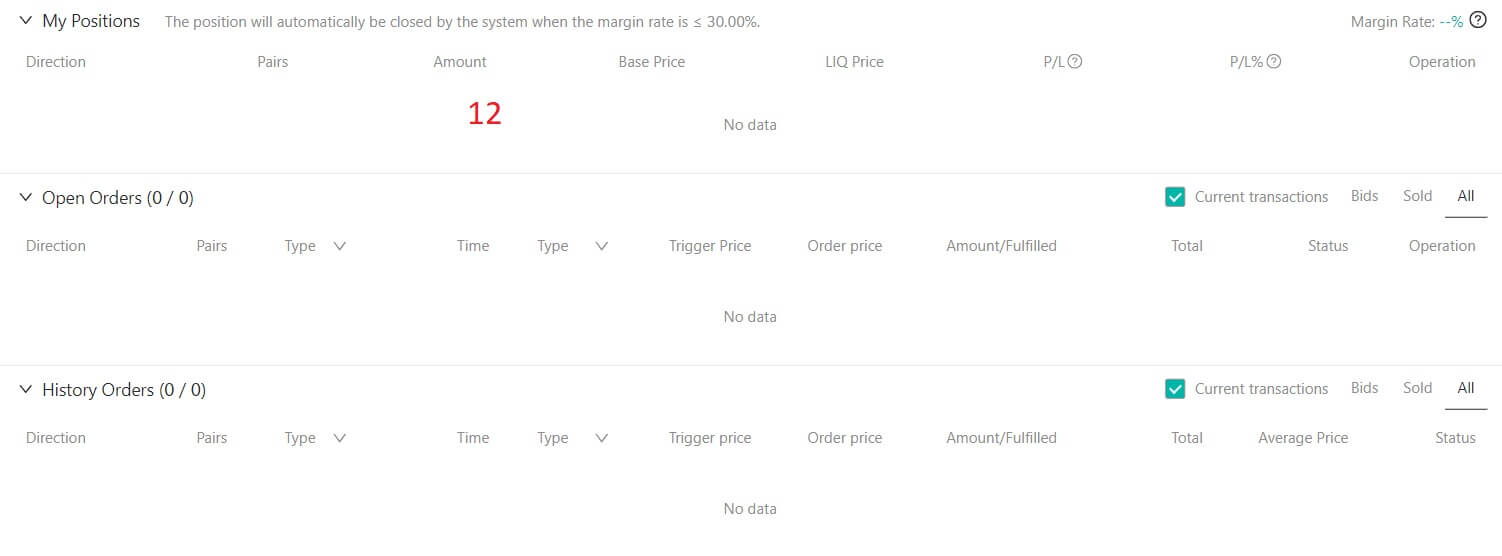

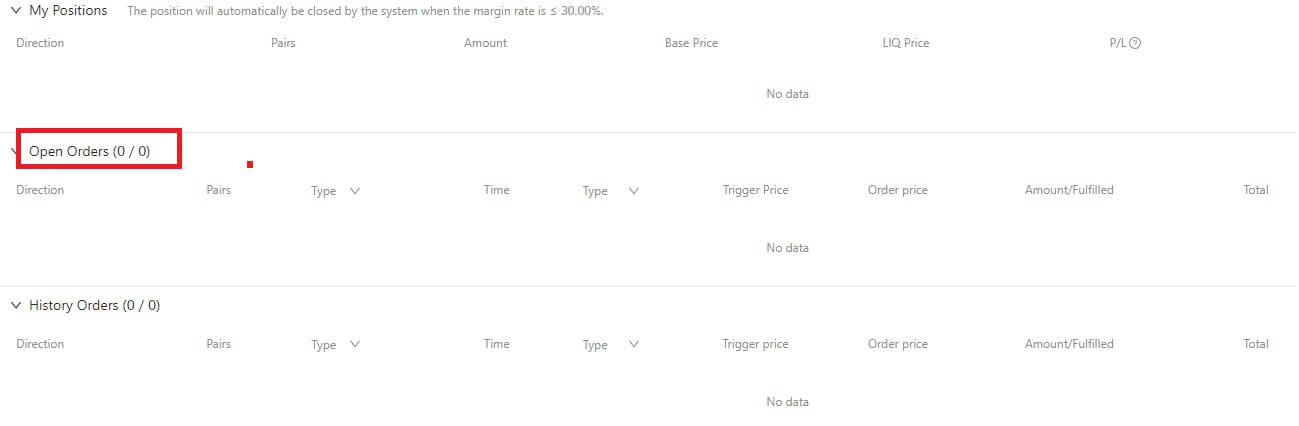

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:

- Trading pair.

- Order Date.

- Order Type.

- Side.

- Order price.

- Order Quantity.

- Order amount.

- Filled %.

- Trigger conditions.

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:

- Trading Pair.

- Order Date.

- Order Type.

- Side.

- Average Filled Price.

- Order Price.

- Executed.

- Order Quantity.

- Order Amount.

- Total amount.